Gabriella’s credit card has an apr of 24 – Gabriella’s credit card, with its annual percentage rate (APR) of 24%, presents a significant financial consideration. This comprehensive guide delves into the intricacies of interest rates, credit card features, and responsible credit card use, empowering individuals to make informed decisions regarding their financial well-being.

In this exploration, we will examine the impact of APRs on credit card balances, compare different types of credit cards, and provide strategies for managing credit card debt effectively. Additionally, we will shed light on credit card security measures, fraud prevention techniques, and the benefits of credit card rewards programs.

Interest Rates and Annual Percentage Rates (APRs)

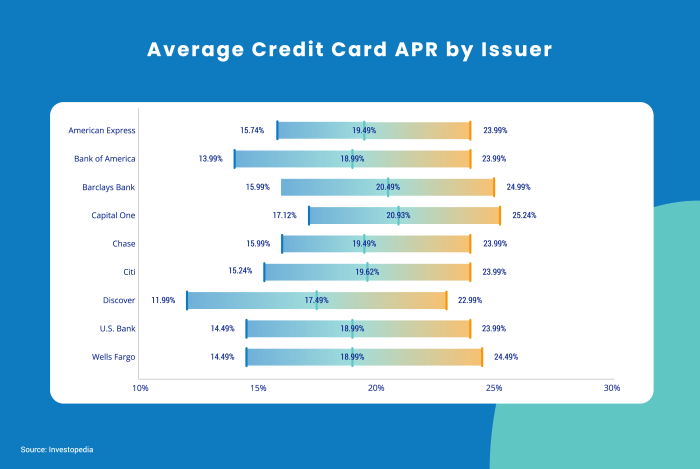

Interest rates are the charges levied on borrowed money, while Annual Percentage Rates (APRs) represent the total cost of borrowing, including interest and other fees. APRs are typically expressed as a percentage and are calculated based on the interest rate, the length of the loan, and the frequency of compounding.

Higher APRs result in higher borrowing costs and can significantly impact credit card balances.

Impact of APRs on Credit Card Balances, Gabriella’s credit card has an apr of 24

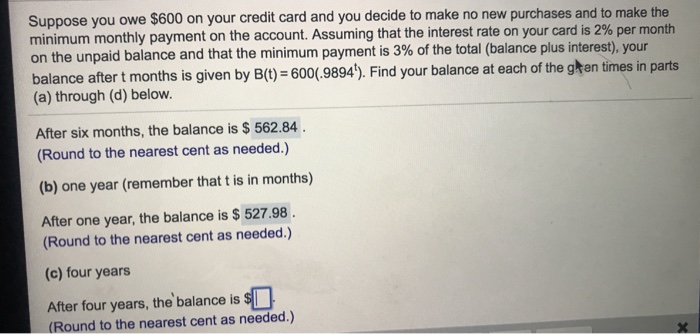

APRs play a crucial role in determining the amount of interest charged on credit card balances. A higher APR leads to a higher interest charge, which in turn increases the overall balance owed. For example, if a credit card has an APR of 24% and a balance of $1,000, the monthly interest charge would be $20 (1,000 x 0.24 / 12). Over time, this interest can accumulate and become a significant financial burden.

Credit Card Features and Benefits

Credit cards offer various features and benefits that can enhance financial management and convenience. These include:

Rewards Programs

- Earn points or cash back on purchases.

- Redeem rewards for travel, merchandise, or statement credits.

- Accelerated rewards categories for specific spending.

Balance Transfer Options

- Transfer high-interest balances to a lower-interest credit card.

- Consolidate debt and save on interest charges.

- Introductory 0% APR periods on balance transfers.

Other Features

- Extended warranties on purchases.

- Travel insurance and emergency assistance.

- Contactless payment options.

Credit Card Debt and Management

Credit card debt can arise due to overspending, high interest rates, or financial emergencies. Managing credit card debt effectively is crucial to avoid financial distress.

Causes of Credit Card Debt

- Excessive spending beyond means.

- High interest rates and fees.

- Unexpected expenses or financial emergencies.

- Poor financial planning and budgeting.

Consequences of Credit Card Debt

- Increased financial stress and anxiety.

- Damage to credit score.

- Difficulty obtaining future credit.

- Legal consequences in extreme cases.

Credit Card Security and Fraud Prevention: Gabriella’s Credit Card Has An Apr Of 24

Credit card fraud involves the unauthorized use of a credit card for financial gain. Protecting against fraud is essential to safeguard financial well-being.

Types of Credit Card Fraud

- Identity theft and account takeover.

- Counterfeit or cloned cards.

- Online scams and phishing.

- Card skimming and data breaches.

Fraud Prevention Tips

- Use strong passwords and update them regularly.

- Monitor credit reports for unauthorized activity.

- Be cautious of phishing emails and suspicious websites.

- Use chip-enabled cards and contactless payment methods securely.

- Report lost or stolen cards immediately.

Helpful Answers

What factors influence the APR on a credit card?

Factors such as credit score, credit history, and the type of credit card can affect the APR.

How can I reduce the impact of the 24% APR on my credit card balance?

Making timely payments, paying more than the minimum amount due, and considering a balance transfer to a card with a lower APR can help reduce the impact.

What are some tips for protecting myself from credit card fraud?

Using strong passwords, monitoring credit reports regularly, and being cautious of phishing scams can help prevent fraud.