Enter a formula using pv in cell b6 – Delving into the realm of financial analysis, this guide provides a thorough exploration of the Present Value (PV) formula. By entering the formula in cell B6, we embark on a journey to understand its components, applications, and limitations.

Unveiling the intricacies of the PV formula, we delve into its syntax and usage, empowering you to harness its capabilities. Practical examples illustrate its real-world applications, solidifying your understanding of its significance.

1. PV Formula Overview

The Present Value (PV) formula is a fundamental concept in financial analysis. It calculates the current value of a future sum of money, taking into account the time value of money and a given discount rate.

The PV formula consists of three main components: the future value, the discount rate, and the number of periods.

2. Syntax and Usage of PV Formula

Syntax

The syntax of the PV formula in Microsoft Excel is:

=PV(rate, nper, pmt, [fv], [type])

Arguments, Enter a formula using pv in cell b6

- rate: The annual discount rate

- nper: The number of periods

- pmt: The periodic payment (optional)

- fv: The future value (optional; default is 0)

- type: The type of payment (optional; 0 for end of period, 1 for beginning of period; default is 0)

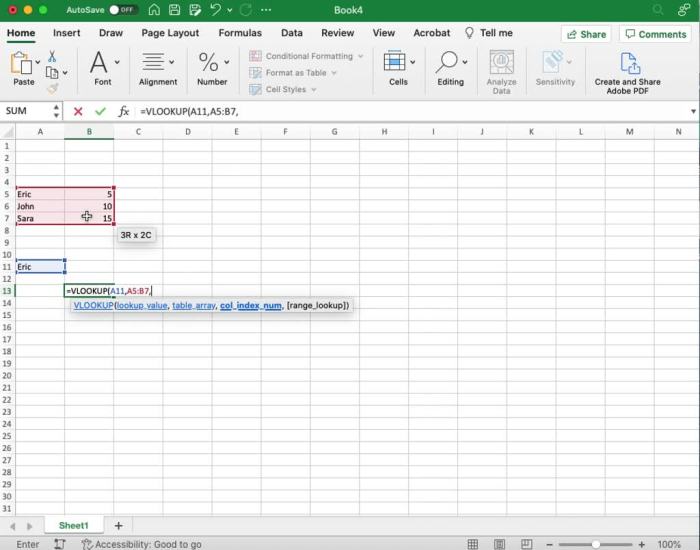

Entering the Formula in Cell B6

To enter the PV formula in cell B6, follow these steps:

- Select cell B6.

- Type the following formula:

- Replace the placeholders with the appropriate values.

- Press Enter.

=PV(rate, nper, pmt, [fv], [type])

3. Examples of PV Calculations

Consider the following examples:

- To calculate the present value of $1,000 to be received in 5 years at a 5% discount rate, use the formula:

- To calculate the present value of a $100 monthly payment for 10 years at a 4% discount rate, use the formula:

=PV(5%, 5, 0, 1000)

=PV(4%, 10,-100)

| Input | PV |

|---|---|

| $1,000 in 5 years at 5% | $822.70 |

| $100 monthly payment for 10 years at 4% | $898.47 |

4. Applications of PV Formula

The PV formula has numerous applications in financial analysis, including:

- Evaluating investment opportunities

- Determining the value of bonds and other fixed-income securities

- Planning for retirement and other long-term financial goals

- Assessing the cost of borrowing

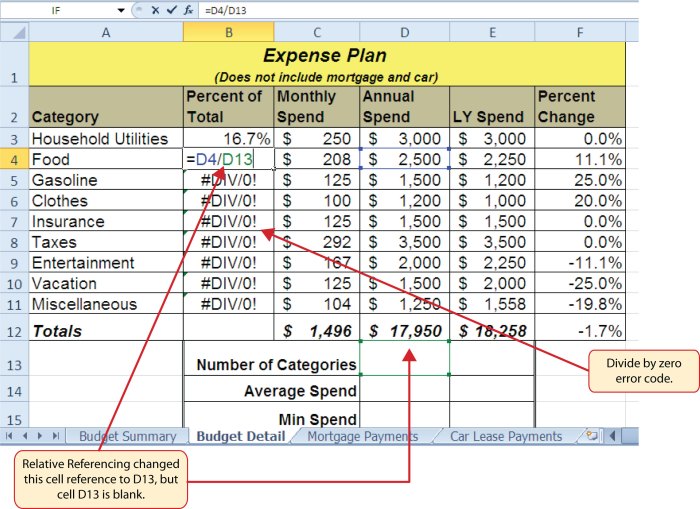

5. Limitations of PV Formula

While the PV formula is a powerful tool, it has certain limitations:

- It assumes that the discount rate remains constant over the entire period.

- It does not account for inflation or other factors that may affect the value of money over time.

- It is based on the assumption that the cash flows are certain.

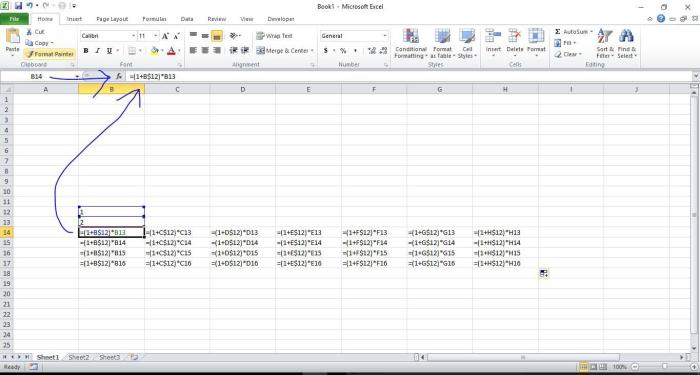

6. Advanced Usage of PV Formula

The PV formula can be used in conjunction with other financial functions for advanced analysis, such as:

- NPV: Calculating the net present value of a series of cash flows

- IRR: Determining the internal rate of return on an investment

- PMT: Calculating the periodic payment required to repay a loan

FAQ: Enter A Formula Using Pv In Cell B6

What is the purpose of the PV formula?

The PV formula calculates the present value of a future sum of money, considering the time value of money and a specified interest rate.

How do I enter the PV formula in cell B6?

In cell B6, enter the formula “=PV(rate, nper, pmt, [fv], [type])”, where “rate” is the interest rate, “nper” is the number of periods, “pmt” is the periodic payment, “fv” is the future value (optional), and “type” indicates when payments are made (optional).

What are the limitations of the PV formula?

The PV formula assumes constant interest rates and regular payments, which may not always reflect real-world scenarios. It also does not consider inflation or other economic factors.